How can I buy ETFs from the USA

Would you like to add one of the largest U.S.-traded ETFs to your portfolio, but can’t? I have a solution for you.

KID in English required

If you have a trading account with one of the better brokers, such as Interactive Brokers, you generally have access to the world’s most well-known international financial markets, including the U.S. In addition to the largest corporations globally, the best-known and most popular ETFs are traded here.

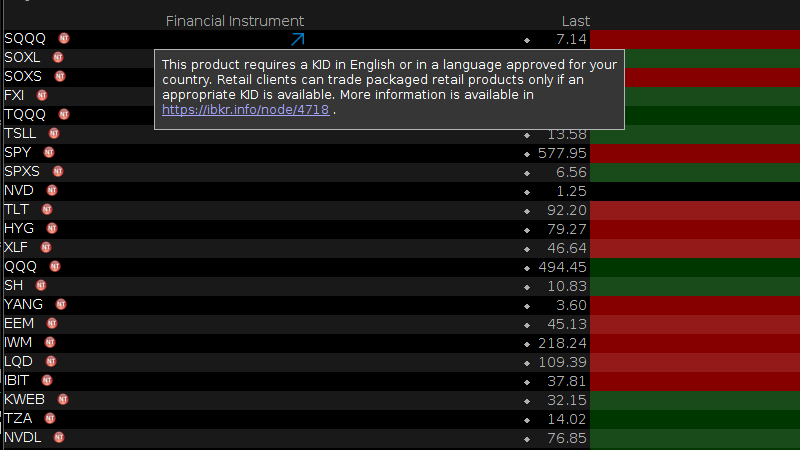

However, there’s a problem. If you’re based in Germany or certain other European countries and try to buy ETFs like SPY, QQQ, EEM, IWM, or IBIT on Interactive Brokers, you’ll receive the following message:

This Product requires a KID in English or in a Language approved for your Country. Retail Clients can trade packaged retail products only if an appropriate KID is available.

In other words, you can’t buy or short these ETFs. But there’s a simple way to get your hands on these sought-after ETFs.

Selling Naked Puts

Firstly, selling (shorting) naked puts is a solid options strategy where you collect the premium. Selling put options is also a great way to acquire stocks or ETFs at a discount. For instance, let’s say you want to buy Blackrock’s IBIT Bitcoin ETF, and the current price is $38. You could simply sell an “in-the-money” put with a short expiration, for example, a $40 put. If you sell this put for $4, and it expires when the IBIT price is at $38, you’ll receive the IBIT ETF at $40—$2 above the current price—plus you collect the $4 premium. Essentially, you’ve acquired the ETF for a net cost of $36.

Selling puts not only allows you to access products that you otherwise wouldn’t be able to trade, but you also get to keep the premium value.