What are Futures

To trade options, you should be familiar with the most common financial products. Options are available on, among others, indices, commodities, stocks, futures, ETFs, currencies, interest rates, crypto assets, volatility, and synthetic products.

What are Futures?

Futures are a type of financial contract where two parties agree to buy or sell an asset (such as commodities, stocks, currencies, or other financial instruments) at a set price on a future date. These contracts are binding, and the price is determined today, while the actual delivery or settlement of the transaction takes place in the future.

How do futures work?

Imagine you’re a farmer growing wheat. You want to ensure that you get a good price for your harvest, even if the market price drops later on. You could enter into a futures contract that allows you to lock in a price today, even though you’ll only deliver your wheat in a few months. On the other side, a baker who needs wheat might buy this contract to protect against rising prices. This way, both parties know today what the price of wheat will be, regardless of future market changes.

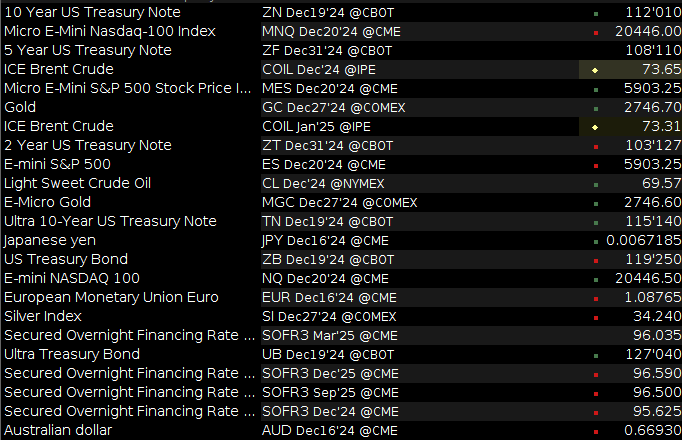

Futures contracts can be made for a wide range of assets, from agricultural products like wheat and corn to commodities like oil and gold, and even financial assets like stock indexes or currencies.

The origins of futures

The concept of futures has existed for centuries. These contracts originally developed in agriculture to provide price stability for both farmers and buyers. The oldest recorded futures market dates back to mid-18th century Japan, where rice futures were used by rice farmers and merchants to manage price fluctuations.

The modern futures market began in 1848 in the United States with the founding of the Chicago Board of Trade (CBOT). This exchange offered standardized contracts, making trading more efficient and secure. Back then, they mainly traded agricultural products like wheat and corn, but over time, the market expanded to include metals, energy, and financial products.

Why were futures developed?

Futures were developed to protect people from price volatility and reduce risk. Farmers could hedge against falling prices, while buyers (such as factories or merchants) could hedge against rising prices. Today, speculators also use futures to bet on price movements without having to own the underlying asset. This makes the market more liquid and attractive to different types of investors.

Overall, futures offer both protection against risk and opportunities for speculative profits, making them an important tool in the modern financial world.